Rolex’s market share exceeds 30%

1.24 million watches, 10.1 billion Swiss francs in revenue, Rolex handed over the best performance in history last year.

Morgan Stanley and LuxeConsult, a Swiss consulting firm, recently released an annual report on the watch industry, showing that Rolex, the king of watches, achieved a revenue of 10.1 billion Swiss francs last year, breaking through the 10 billion mark for the first time, accounting for slightly more than 30% of the retail market share. Cartier, owned by Richemont Group, and Omega, owned by Swatch Group, occupy the second and third places in the ranking with 3.1 billion Swiss francs and 2.6 billion Swiss francs respectively.

In this report, analysts said that Rolex’s sales "exceed the combined sales of Cartier, Omega, Audemars Piguet, Patek Philippe and Richard Mille".

At present, independent brands occupy a dominant position in the watch industry, while the share of listed groups is limited. According to Morgan Stanley’s data, affected by Rolex’s dominance, the market shares of Swatch, LVMH and Richemont all declined in different degrees in 2023, and currently account for 19.4%, 18.7% and 5.8% of the total retail sales respectively.

Luxury giants are also continuing to increase their watch business. In February last year, LVMH announced that it would restart the Swiss watch brand Daniel Roth to operate as an independent brand. At the beginning of this year, the group reorganized its watch and jewelry department and appointed Frederic Arnault, the fourth son of Bernard Arnault, the head of the group, as the department leader.

7 years after delisting, Belle Fashion went to Hong Kong for IPO.

Seven years after privatization and delisting, the largest fashion shoe company in China has returned to the capital market.

Recently, Belle Fashion Group officially submitted its listing application on the Hong Kong Stock Exchange. According to the prospectus, in the nine months ended November 30, 2023, Belle Fashion achieved revenue of 16.1 billion yuan, with a net profit margin of 12.8%, which was the highest level during the track record period.

Belle Fashion is the largest fashion footwear company in China at present, with 19 core brands, including women’s shoes, men’s shoes, children’s shoes, clothing and accessories, covering different orientations from mass to high-end and diverse styles. In addition to enriching the brand matrix, Belle Fashion is constantly expanding its sales channels. In the first three quarters of last year, the proportion of brand online channel revenue reached about 28%, while before privatization, this proportion was less than 7%.

It is worth noting that in March, 2022, Belle Fashion submitted the IPO declaration of Hong Kong stocks, but it ended in failure.

The history of Belle Fashion can be traced back to the 1970s, when Deng Yao, a famous shoe designer in Hong Kong, founded Belle International, whose main business includes Belle Fashion related business and sports shoes and clothing retail business. In 2007, Belle International landed on the Hong Kong Stock Exchange. In July 2017, the consortium including Gaochun Capital completed the privatization of Belle International.

After 7 years of precipitation, it is worth paying attention to what possibilities Belle Fashion will have in the future.

Hermes continues to expand its business in Asia

Asia is still the "backbone" of the luxury goods market.

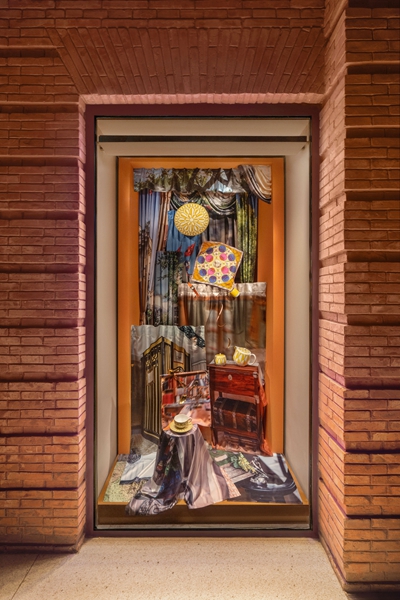

Recently, Hermes is expanding its retail business in the Asian market, opening a new store in Tokyo, Japan, and renovating its old store in Kuala Lumpur, Malaysia. Up to now, Hermes has about 40 stores in Japan and 3 stores in Malaysia.

The new Tokyo store is still designed by RDAI, a French architectural design company, and is located in Mabaishan, which is a two-story independent store. Hermes store in The Gardens Mall, Kuala Lumpur, Malaysia, reopened after renovation and expansion ten years after its first opening.

In the background of the cold luxury goods industry, Hermes still recorded brilliant sales performance. Last year, the group’s comprehensive revenue reached 13.4 billion euros, an increase of 21% at a fixed exchange rate. The net profit reached 4.3 billion euros, up 28% year-on-year, faster than the three luxury goods groups, namely LVMH, Kaiyun and Lifeng. Among them, the growth rate in Asia reached 19%, while Japan maintained sustained and steady growth, with a year-on-year increase of 26%.

According to the latest luxury market research report jointly released by Bain Consulting and Italian luxury manufacturers’ industry association, the Asian market led the growth pace of luxury market in 2023. Hermes chose to continue to exert its strength in the Asian market, which is precisely because of the consumption vitality in the region.

Miu Miu’s growth rate is bright

In 2023, when the luxury goods industry was striving for stability, MiuMiu came out with a rare growth curve.

On March 7th, the Italian luxury goods group Prada released its financial year 2023 performance report. Thanks to the high market demand for Prada and Miu Miu, its net revenue increased by 13% year-on-year to 4.7 billion euros, and its retail sales increased by 17% year-on-year to 4.2 billion euros at a fixed exchange rate.

Among them, the biggest highlight comes from Miu Miu. According to the financial report, its sales revenue in 2023 increased by 58% year-on-year to 649 million euros. This increase is much higher than that of its Italian counterparts Brunello Cucinelli and Dzheniya Group, and that of Miu Miu is nearly twice as high.

Miu Miu’s explosion is inseparable from stylized marketing — — The youthful and lively design attracts the attention of young consumers, and it is also a common way for Miu Miu to show his youthful attitude to choose artists who have just started their careers but have distinctive personal styles to promote their products.

However, the other side of stylization is that it is easily influenced by trends. This makes it difficult for Miu Miu to show its own brand characteristics through explosions and star products. In order to cope with this problem, it recently launched a series of perfumes in cooperation with L ‘Oré al Group, trying to find new growth points in the track of olfactory economy.

French luxury brands will reduce China stores.

Mid-end luxury brands are facing operational difficulties and have to reduce the number of stores.

SMCP Group, the parent company of French brands Sandro, Maje and Claudie Pierlot, recently released its performance report for 2023. The sales increased slightly by 4% to 1.231 billion euros at a fixed exchange rate, and the net profit dropped from 51 million euros in the previous year to 11 million euros.

SMCP said in its financial report that the performance of China market was lower than expected. In the newly disclosed transformation plan, it plans to reduce the sales network in China market by about 15%.

In 2016, China clothing company Shandong Ruyi acquired SMCP. Compared with Coach and Michael Kors, which started earlier and had higher market share, SMCP’s luxury brands entered the China market late and lacked the first Mover advantage. In addition, Shandong Ruyi was caught in a debt crisis and could not promote large-scale brand expansion. SMCP broke up with Shandong Ruyi in 2022.

When the economic environment is full of uncertainty, the middle class, consumption power and demand targeted by luxury brands also decline accordingly. To make matters worse, the main categories of Sandro and Maje are popular clothes that lack value preservation and recognition, and they are the first to be "abandoned".

(Image from various brands of Weibo)